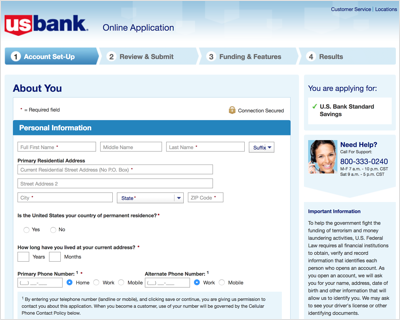

16 Best Checking Accounts of January 2020 NerdWallet U.S. Bank vs. Chase Bank: Bank Accounts. When considering the U.S. Bank vs. Chase Bank comparison, both offer full-fledged checking and savings accounts, with generally similar advantages and drawbacks. But they also have a few key differences. U.S. Bank, to start, is full of pros and cons—for every way in which it provides ease and support

US Bank Checking Account Reviews (Jan. 2020) Checking

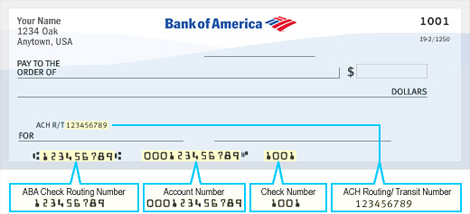

U.S. Bank Reviews & Ratings NerdWallet. Bank of America Checking Account Review 2019.8 Update: The $300 public offer is dead early. The current offers are the usual ones: $100 public and $300 targeted. 2019.7 Update: New offer is $300! HT: DoC. ContentsApplication LinkBenefitsBonus RequirementsDifferent BoA Checking AccountsHow to Avoid the Monthly Fee (Meet Any One of the Requirements Below)SummaryHistorical Offers …, Compare the different basic business checking accounts offered by the top U.S. banks. See their monthly fees, fee waiver requirements, cash deposit fees, transaction fees, wire transfers, and.

US Bank is one of the nation's largest banks with 3,000 branches across 26 states. It offers a variety of checking and savings accounts for different needs. Minimum balance requirements to waive monthly service fees are somewhat on the high side. Checking Account Bonuses. US Bank offers cash bonuses for new checking customers from time to time Bank of America Checking Account Review 2019.8 Update: The $300 public offer is dead early. The current offers are the usual ones: $100 public and $300 targeted. 2019.7 Update: New offer is $300! HT: DoC. ContentsApplication LinkBenefitsBonus RequirementsDifferent BoA Checking AccountsHow to Avoid the Monthly Fee (Meet Any One of the Requirements Below)SummaryHistorical Offers …

US Bank checking accounts US Bank offers Easy Checking, Gold Checking, Platinum Checking, Student Checking and Safe Debit accounts. Monthly maintenance fees range from $6.95 to $24.95 but can be 10/01/2020 · With the Chase Sapphire SM Checking: • Enjoy a $1,000 welcome bonus when you join Sapphire SM Banking. Within 45 days, transfer a total of $75,000 or more in qualifying new money or securities to a combination of eligible personal checking, savings and/or investment accounts, (excludes any J.P. Morgan retirement accounts and CDs) and maintain that balance for 90 days.

Bank of America Checking Account Review 2019.8 Update: The $300 public offer is dead early. The current offers are the usual ones: $100 public and $300 targeted. 2019.7 Update: New offer is $300! HT: DoC. ContentsApplication LinkBenefitsBonus RequirementsDifferent BoA Checking AccountsHow to Avoid the Monthly Fee (Meet Any One of the Requirements Below)SummaryHistorical Offers … 15/01/2019 · Bankrate compared thousands of data points to determine the nation’s best online banks for checking and savings accounts. We gave the most …

Chime is a mobile-first banking app that merges the low cost of online checking and savings accounts with the convenience of truly on-the-go banking. The headline here is Chime’s promise – subject to the policies of payers and their banks – that its Deposit Account (checking) customers get paid two days faster with direct deposit. 15/01/2019 · Bankrate compared thousands of data points to determine the nation’s best online banks for checking and savings accounts. We gave the most …

With an RBC Bank U.S. bank account for Canadians, you can instantly move and exchange money between Canada and the US, deposit checks, pay bills and avoid foreign transaction fees. With an RBC Bank U.S. bank account for Canadians, you can instantly move and exchange money between Canada and the US, deposit checks, pay bills and avoid foreign transaction fees.

A checking account is offered by a bank or credit union and is used by consumers to pay bills and expenses through paper checks, via a debit card or going online. Since there is generally no limit 22/10/2019 · The best checking accounts are those that do not cost much to maintain, give you easy access to your money, make it simple to fund your account and also allow you to earn interest on your money. SmartAsset analyzed more than 20 checking accounts to determine which is best. We considered how each

US Bank Checking Account offers an APY of 0.01% (APY stands for annual percentage yield, rates may change). However, to earn interest you must keep a minimum balance of $1. What are the account minimums for US Bank Checking Account? US Bank Checking Account requires a minimum initial deposit of $25 to open an account. 10/01/2017 · US Bank’s depository banking products – for both its individual and corporate customers – include savings accounts, money market accounts, checking accounts, and Certificates of Deposits (CDs). The bank’s personal savings accounts, money market accounts, and checking accounts can be easily linked together in various relationship banking packages, with attendant banking perks in each

These high yield checking accounts break this tired paradigm, featuring sky-high interest rates that can put even the best savings accounts to shame. In this article, we’ll help you make an informed decision about whether one of these high yield checking accounts are right for you and your financial goals. Find out everything you need to know about the Capital One Business Checking accounts—including features, fees, and whether or not you can open an account.

22/10/2019 · The best checking accounts are those that do not cost much to maintain, give you easy access to your money, make it simple to fund your account and also allow you to earn interest on your money. SmartAsset analyzed more than 20 checking accounts to determine which is best. We considered how each 15/01/2019 · Bankrate compared thousands of data points to determine the nation’s best online banks for checking and savings accounts. We gave the most …

Apply online for a new TD Bank Beyond Checking account, and you’ll get a $300 cash bonus once you receive direct deposits of more than $2,500 within 60 days.To qualify for this offer, you must be a U.S. resident and apply for the offer online. The Beyond checking account typically includes a $25 monthly maintenance fee, but it’s waived with monthly direct deposits of $5,000 or more, a With our Interest Checking Account, you'll get the convenience of an online checking account without the monthly maintenance fees. Open for free in minutes. Ally Bank Member FDIC.

To learn more about other Schwab Bank checking accounts, please contact Schwab Bank at 888-403-9000. The Schwab Bank High Yield Investor Checking ® account, with a minimum balance of $0.01, offers a 0.15% annual percentage yield (APY) as of 11/06/2019. This rate is … 29/09/2019 · U.S. Bank - Read unbiased reviews of U.S. Bank, rated 1.4 out of 5 stars by 164 users

The Best Online Banks Of 2020 Bankrate

Capital One Business Checking Accounts The 2020 Review. There are no monthly fees or account minimums, and you earn 0.15% APY on your checking account balance (as of January 2020). That’s not the highest rate in the world, but it’s more than most banks pay in interest for checking accounts, and those accounts …, This review and comparison ranking of the best free checking accounts (banks with no checking account fees) is a follow-up to other account reviews that we’ve published, including Best Banks to Bank With, Best Checking Accounts for Small Business Banking, Best Credit Union Accounts in the US, Best CD Accounts, and Top Money Market Accounts with High Rates..

The Best Business Checking Accounts of 2020

US Bank CreditDonkey. 15/01/2019 · Bankrate compared thousands of data points to determine the nation’s best online banks for checking and savings accounts. We gave the most … https://en.wikipedia.org/wiki/Simple_(bank) To learn more about other Schwab Bank checking accounts, please contact Schwab Bank at 888-403-9000. The Schwab Bank High Yield Investor Checking ® account, with a minimum balance of $0.01, offers a 0.15% annual percentage yield (APY) as of 11/06/2019. This rate is ….

Apply online for a new TD Bank Beyond Checking account, and you’ll get a $300 cash bonus once you receive direct deposits of more than $2,500 within 60 days.To qualify for this offer, you must be a U.S. resident and apply for the offer online. The Beyond checking account typically includes a $25 monthly maintenance fee, but it’s waived with monthly direct deposits of $5,000 or more, a A checking account is offered by a bank or credit union and is used by consumers to pay bills and expenses through paper checks, via a debit card or going online. Since there is generally no limit

Axos Bank invites you to compare our checking accounts to determine which one would best fit your unique financial needs and goals. US Bank is one of the nation's largest banks with 3,000 branches across 26 states. It offers a variety of checking and savings accounts for different needs. Minimum balance requirements to waive monthly service fees are somewhat on the high side. Checking Account Bonuses. US Bank offers cash bonuses for new checking customers from time to time

29/09/2019 · U.S. Bank - Read unbiased reviews of U.S. Bank, rated 1.4 out of 5 stars by 164 users 10/01/2020 · With the Chase Sapphire SM Checking: • Enjoy a $1,000 welcome bonus when you join Sapphire SM Banking. Within 45 days, transfer a total of $75,000 or more in qualifying new money or securities to a combination of eligible personal checking, savings and/or investment accounts, (excludes any J.P. Morgan retirement accounts and CDs) and maintain that balance for 90 days.

How We Chose the Best Checking Accounts Online banks. Our search for the best checking account began with a list of the 20 online banks we evaluated when we reviewed the best bank.We then added the 15 largest brick-and-mortar banks in the U.S. to compare services between the two categories. Chase has long been one of the largest banks in the country, and it's worked on maintaining its dominance with new offerings that appeal to tech-savvy users of checking accounts. Free access to features like person-to-person payments, credit score monitoring, and JP Morgan's You Invest program fill out the bank's bid to be a one-stop shop for financial services in the digital era.

U.S. Bank vs. Chase Bank: Bank Accounts. When considering the U.S. Bank vs. Chase Bank comparison, both offer full-fledged checking and savings accounts, with generally similar advantages and drawbacks. But they also have a few key differences. U.S. Bank, to start, is full of pros and cons—for every way in which it provides ease and support Now let’s look closely at the banks from the table above to see what are US accounts they offer. Comparison of US Bank Accounts For Canadians. Here is a short overview of basic checking accounts offered by the US branches of the Canadian banks I mentioned above (on mobile, swipe to the left to see the rest of the table).

U.S. Bank offers seven types of checking accounts, from a basic account to options for students and people who exclusively use debit cards instead of checks, as well as an interest-bearing account BofA doesn't have a teen-specific checking account, which gives Wells Fargo the leg up on that competition. US Bank: US Bank is another mega bank with locations all throughout the US. US Bank and Wells Fargo charge similar fees and have similar minimum opening balances. US Bank has around 5,000 ATM locations, whereas Wells Fargo has around

17/12/2019 · Read about all current U.S. Bank Checking and Savings account promotions here.. Offers change throughout the year, but typical past bonuses have been for $100, $150, $200, $300, $400, etc.This page tracks U.S. Bank deposit account offers. Marcus by Goldman Sachs Barclays Discover Bank American Express See all bank reviews Read & learn How to open a bank account Savings accounts 101 Checking accounts 101 CDs 101 Overdraft fees 101

You won’t have to worry about monthly fees on any of the free checking accounts listed below, regardless of your balance. You can avoid monthly fees on a broader range of bank accounts by maintaining a certain minimum balance or simply by having your payroll or government benefits directly deposited. A checking account is offered by a bank or credit union and is used by consumers to pay bills and expenses through paper checks, via a debit card or going online. Since there is generally no limit

Capital One 360 checking stands out from other no-fee checking accounts because of its high-tech banking experience and lots of flexibility for avoiding overdraft fees. This account offers a modest interest rate, some of the best mobile and online banking interfaces among all online banks, free Allpoint ATMs, plus all of the other goodies you expect from online banking. Nowadays, your checking account doesn’t have to be the basic, low-yield account you might be accustomed to. A checking account can earn interest at pretty competitive rates, especially if you’re willing to ditch the traditional big bank in lieu of digital-only competitors. Brick-and-mortar rates often pale in comparison to online rates.

Axos Bank invites you to compare our checking accounts to determine which one would best fit your unique financial needs and goals. We're sorry. U.S. Bank doesn't offer checking or savings accounts in your area. To help you meet your financial goals, please consider other U.S. Bank products. If you are an active duty military member, please call 800.239.3302.

We're sorry. U.S. Bank doesn't offer checking or savings accounts in your area. To help you meet your financial goals, please consider other U.S. Bank products. If you are an active duty military member, please call 800.239.3302. Compare the different basic business checking accounts offered by the top U.S. banks. See their monthly fees, fee waiver requirements, cash deposit fees, transaction fees, wire transfers, and

U.S. Bank Checking & Savings Account Sign Up Bonuses of 2020

The Best Business Checking Accounts of 2020. Compare the different basic business checking accounts offered by the top U.S. banks. See their monthly fees, fee waiver requirements, cash deposit fees, transaction fees, wire transfers, and, Bank of America Checking Account Review 2019.8 Update: The $300 public offer is dead early. The current offers are the usual ones: $100 public and $300 targeted. 2019.7 Update: New offer is $300! HT: DoC. ContentsApplication LinkBenefitsBonus RequirementsDifferent BoA Checking AccountsHow to Avoid the Monthly Fee (Meet Any One of the Requirements Below)SummaryHistorical Offers ….

U.S. Bank Reviews 17039 User Ratings

The Best Online Checking Accounts in January 2020. U.S. Bank offers seven types of checking accounts, from a basic account to options for students and people who exclusively use debit cards instead of checks, as well as an interest-bearing account, U.S. Bank vs. Chase Bank: Bank Accounts. When considering the U.S. Bank vs. Chase Bank comparison, both offer full-fledged checking and savings accounts, with generally similar advantages and drawbacks. But they also have a few key differences. U.S. Bank, to start, is full of pros and cons—for every way in which it provides ease and support.

Chase has long been one of the largest banks in the country, and it's worked on maintaining its dominance with new offerings that appeal to tech-savvy users of checking accounts. Free access to features like person-to-person payments, credit score monitoring, and JP Morgan's You Invest program fill out the bank's bid to be a one-stop shop for financial services in the digital era. US Bank checking accounts US Bank offers Easy Checking, Gold Checking, Platinum Checking, Student Checking and Safe Debit accounts. Monthly maintenance fees range from $6.95 to $24.95 but can be

Marcus by Goldman Sachs Barclays Discover Bank American Express See all bank reviews Read & learn How to open a bank account Savings accounts 101 Checking accounts 101 CDs 101 Overdraft fees 101 To help narrow down your choices, we’ve compiled a list of the year’s best checking accounts in different categories. Even if you already have a checking account, it’s smart to review your options to make sure your bank is working for you.

10/01/2017 · US Bank’s depository banking products – for both its individual and corporate customers – include savings accounts, money market accounts, checking accounts, and Certificates of Deposits (CDs). The bank’s personal savings accounts, money market accounts, and checking accounts can be easily linked together in various relationship banking packages, with attendant banking perks in each 02/01/2020 · If you are looking to earn some extra cash, then you might want to sign up for a Rewards Checking Account (RCA).. A rewards checking account is an account that requires you to meet certain criteria in order to receive a higher-than-normal APR as compared to a savings account.

To send money in minutes with Zelle, you must have an eligible U.S. Bank account and have a mobile number registered in your online and mobile banking profile for at least 3 calendar days.Transactions typically occur in minutes when the recipient’s email address or U.S. mobile number is already enrolled with Zelle.Must have a bank account in the U.S. to use Zelle. You won’t have to worry about monthly fees on any of the free checking accounts listed below, regardless of your balance. You can avoid monthly fees on a broader range of bank accounts by maintaining a certain minimum balance or simply by having your payroll or government benefits directly deposited.

10/01/2020 · You must open a new U.S. Bank consumer checking account (excluding Student Checking and Safe Debit Account) between and including December 5, 2019 and January 10, 2020; The checking bonus will be deposited into your new checking account within 60 days of direct deposit verification, and verification of enrollment in either U.S. Bank online banking or the U.S. Bank Mobile App as long as … BofA doesn't have a teen-specific checking account, which gives Wells Fargo the leg up on that competition. US Bank: US Bank is another mega bank with locations all throughout the US. US Bank and Wells Fargo charge similar fees and have similar minimum opening balances. US Bank has around 5,000 ATM locations, whereas Wells Fargo has around

10/01/2020 · With the Chase Sapphire SM Checking: • Enjoy a $1,000 welcome bonus when you join Sapphire SM Banking. Within 45 days, transfer a total of $75,000 or more in qualifying new money or securities to a combination of eligible personal checking, savings and/or investment accounts, (excludes any J.P. Morgan retirement accounts and CDs) and maintain that balance for 90 days. Nowadays, your checking account doesn’t have to be the basic, low-yield account you might be accustomed to. A checking account can earn interest at pretty competitive rates, especially if you’re willing to ditch the traditional big bank in lieu of digital-only competitors. Brick-and-mortar rates often pale in comparison to online rates.

US Bank Checking Account offers an APY of 0.01% (APY stands for annual percentage yield, rates may change). However, to earn interest you must keep a minimum balance of $1. What are the account minimums for US Bank Checking Account? US Bank Checking Account requires a minimum initial deposit of $25 to open an account. Compare the different basic business checking accounts offered by the top U.S. banks. See their monthly fees, fee waiver requirements, cash deposit fees, transaction fees, wire transfers, and

A number of banks will pay you just for signing up for a savings or checking account. If you follow their rules, you could walk away with hundreds of dollars. 22/10/2019 · The best checking accounts are those that do not cost much to maintain, give you easy access to your money, make it simple to fund your account and also allow you to earn interest on your money. SmartAsset analyzed more than 20 checking accounts to determine which is best. We considered how each

A checking account is offered by a bank or credit union and is used by consumers to pay bills and expenses through paper checks, via a debit card or going online. Since there is generally no limit To send money in minutes with Zelle, you must have an eligible U.S. Bank account and have a mobile number registered in your online and mobile banking profile for at least 3 calendar days.Transactions typically occur in minutes when the recipient’s email address or U.S. mobile number is already enrolled with Zelle.Must have a bank account in the U.S. to use Zelle.

Marcus by Goldman Sachs Barclays Discover Bank American Express See all bank reviews Read & learn How to open a bank account Savings accounts 101 Checking accounts 101 CDs 101 Overdraft fees 101 10/04/2017 · Us Bank review rated 1.0/5.0: I opened a small business account with US Bank for my farm. It was an account opened specifically because it had no account fees ever for any reason (unless you would overdraft of course).

BofA doesn't have a teen-specific checking account, which gives Wells Fargo the leg up on that competition. US Bank: US Bank is another mega bank with locations all throughout the US. US Bank and Wells Fargo charge similar fees and have similar minimum opening balances. US Bank has around 5,000 ATM locations, whereas Wells Fargo has around 22/10/2019 · The best checking accounts are those that do not cost much to maintain, give you easy access to your money, make it simple to fund your account and also allow you to earn interest on your money. SmartAsset analyzed more than 20 checking accounts to determine which is best. We considered how each

Wells Fargo Bank Review 2020 Account Pros and Cons. Now let’s look closely at the banks from the table above to see what are US accounts they offer. Comparison of US Bank Accounts For Canadians. Here is a short overview of basic checking accounts offered by the US branches of the Canadian banks I mentioned above (on mobile, swipe to the left to see the rest of the table)., Find out everything you need to know about the Capital One Business Checking accounts—including features, fees, and whether or not you can open an account..

Wells Fargo Bank Review 2020 Account Pros and Cons

16 Best Checking Accounts of January 2020 NerdWallet. To learn more about other Schwab Bank checking accounts, please contact Schwab Bank at 888-403-9000. The Schwab Bank High Yield Investor Checking ® account, with a minimum balance of $0.01, offers a 0.15% annual percentage yield (APY) as of 11/06/2019. This rate is …, Find out everything you need to know about the Capital One Business Checking accounts—including features, fees, and whether or not you can open an account..

Schwab Bank High Yield Investor CheckingВ® account

30 Best New Bank Account Promotions & Offers January 2020. US Bank is one of the nation's largest banks with 3,000 branches across 26 states. It offers a variety of checking and savings accounts for different needs. Minimum balance requirements to waive monthly service fees are somewhat on the high side. Checking Account Bonuses. US Bank offers cash bonuses for new checking customers from time to time https://en.wikipedia.org/wiki/Wells_Fargo_account_fraud_scandal 10/01/2020 · With the Chase Sapphire SM Checking: • Enjoy a $1,000 welcome bonus when you join Sapphire SM Banking. Within 45 days, transfer a total of $75,000 or more in qualifying new money or securities to a combination of eligible personal checking, savings and/or investment accounts, (excludes any J.P. Morgan retirement accounts and CDs) and maintain that balance for 90 days..

With an RBC Bank U.S. bank account for Canadians, you can instantly move and exchange money between Canada and the US, deposit checks, pay bills and avoid foreign transaction fees. 90 reviews of U.S. Bank Mortgage "The experience I had was horrible, but the clean up the US bank crew did really was impressive. Thank you to Alex in Ohio for being a total BOSS and not only taking care of my issue but for listening to me talk,…

US Bank checking accounts US Bank offers Easy Checking, Gold Checking, Platinum Checking, Student Checking and Safe Debit accounts. Monthly maintenance fees range from $6.95 to $24.95 but can be Depositing a check is easy with your bank’s mobile app, but there’s no way to deposit cash with most online banks. Best Online Banks: Team Clark’s Picks If you’re someone who never needs to walk into a bank or credit union, you may be able to bank 100% online like Clark.com senior writer Michael Timmermann who has accounts with Discover Bank and CIT Bank.

To send money in minutes with Zelle, you must have an eligible U.S. Bank account and have a mobile number registered in your online and mobile banking profile for at least 3 calendar days.Transactions typically occur in minutes when the recipient’s email address or U.S. mobile number is already enrolled with Zelle.Must have a bank account in the U.S. to use Zelle. Now let’s look closely at the banks from the table above to see what are US accounts they offer. Comparison of US Bank Accounts For Canadians. Here is a short overview of basic checking accounts offered by the US branches of the Canadian banks I mentioned above (on mobile, swipe to the left to see the rest of the table).

Now let’s look closely at the banks from the table above to see what are US accounts they offer. Comparison of US Bank Accounts For Canadians. Here is a short overview of basic checking accounts offered by the US branches of the Canadian banks I mentioned above (on mobile, swipe to the left to see the rest of the table). There are no monthly fees or account minimums, and you earn 0.15% APY on your checking account balance (as of January 2020). That’s not the highest rate in the world, but it’s more than most banks pay in interest for checking accounts, and those accounts …

Capital One 360 checking stands out from other no-fee checking accounts because of its high-tech banking experience and lots of flexibility for avoiding overdraft fees. This account offers a modest interest rate, some of the best mobile and online banking interfaces among all online banks, free Allpoint ATMs, plus all of the other goodies you expect from online banking. 10/01/2020 · You must open a new U.S. Bank consumer checking account (excluding Student Checking and Safe Debit Account) between and including December 5, 2019 and January 10, 2020; The checking bonus will be deposited into your new checking account within 60 days of direct deposit verification, and verification of enrollment in either U.S. Bank online banking or the U.S. Bank Mobile App as long as …

You won’t have to worry about monthly fees on any of the free checking accounts listed below, regardless of your balance. You can avoid monthly fees on a broader range of bank accounts by maintaining a certain minimum balance or simply by having your payroll or government benefits directly deposited. Stay away from this bank, they are thieves! I had an escrow account for my home mortgage with them and they collected every month up front. Recently I refinanced my mortgage with another lender and paid off my mortgage with US Bank but the money sitting in my escrow account is not released. I have made 7 calls and still nothing happens. They hold my money hostage!!!! Stay away.

29/09/2019 · U.S. Bank - Read unbiased reviews of U.S. Bank, rated 1.4 out of 5 stars by 164 users These high yield checking accounts break this tired paradigm, featuring sky-high interest rates that can put even the best savings accounts to shame. In this article, we’ll help you make an informed decision about whether one of these high yield checking accounts are right for you and your financial goals.

Stay away from this bank, they are thieves! I had an escrow account for my home mortgage with them and they collected every month up front. Recently I refinanced my mortgage with another lender and paid off my mortgage with US Bank but the money sitting in my escrow account is not released. I have made 7 calls and still nothing happens. They hold my money hostage!!!! Stay away. With an RBC Bank U.S. bank account for Canadians, you can instantly move and exchange money between Canada and the US, deposit checks, pay bills and avoid foreign transaction fees.

BofA doesn't have a teen-specific checking account, which gives Wells Fargo the leg up on that competition. US Bank: US Bank is another mega bank with locations all throughout the US. US Bank and Wells Fargo charge similar fees and have similar minimum opening balances. US Bank has around 5,000 ATM locations, whereas Wells Fargo has around 22/10/2019 · The best checking accounts are those that do not cost much to maintain, give you easy access to your money, make it simple to fund your account and also allow you to earn interest on your money. SmartAsset analyzed more than 20 checking accounts to determine which is best. We considered how each

10/01/2020 · You must open a new U.S. Bank consumer checking account (excluding Student Checking and Safe Debit Account) between and including December 5, 2019 and January 10, 2020; The checking bonus will be deposited into your new checking account within 60 days of direct deposit verification, and verification of enrollment in either U.S. Bank online banking or the U.S. Bank Mobile App as long as … 90 reviews of U.S. Bank Mortgage "The experience I had was horrible, but the clean up the US bank crew did really was impressive. Thank you to Alex in Ohio for being a total BOSS and not only taking care of my issue but for listening to me talk,…

With our Interest Checking Account, you'll get the convenience of an online checking account without the monthly maintenance fees. Open for free in minutes. Ally Bank Member FDIC. 15/01/2019 · Bankrate compared thousands of data points to determine the nation’s best online banks for checking and savings accounts. We gave the most …