My driving discount device reviews Leeds and Grenville

TD MyAdvantage Safe Driving Discount TD Insurance My discount ranged somewhere near 10% for most of the 90 days and then weirdly went down to 9% just before it ended. Once the 90 days were over the app notified me that I had secured my 9% discount for as long as I have this car under this policy and that Liberty Mutual would no longer track my driving. I get to keep the Automatic device for

Progressive's "Snapshot" device discount is absolutely not

My 90 Days with Telematics in the Car InsNerds.com. Tomlinson told KIRO 7 his electrical system began failing soon after he plugged in the device. "I was driving to work, and if I didn't keep my foot in it, the engine would die," he said., Your discount is calculated based on how safely you drive*. By avoiding distractions and risky behaviour on the road, you could save up to 30%. Keep track of how you’re doing after every trip with your Safety Score and use this feedback to optimize your driving – and your potential discount! It's an easy-to-understand snapshot as several factors are used to calculate your discount. What.

Your discount is calculated based on how safely you drive*. By avoiding distractions and risky behaviour on the road, you could save up to 30%. Keep track of how you’re doing after every trip with your Safety Score and use this feedback to optimize your driving – and your potential discount! It's an easy-to-understand snapshot as several factors are used to calculate your discount. What I think this should solve my worries of driving too many miles, idling too much, driving at night time, and hard braking to maximize the discount rate to 40% off as advertised. Now.. I just have to think about how much energy that's going to cost me over the next few months to have it plugged in constantly.

So, I hooked the thing up to my car and completely forgot about it. That was, until, I got an email from Allstate explaining that I could track my Drivewise discount on … SmartRide is offered as an optional program to any Nationwide member who has auto insurance. The program gives you an instant 5% auto insurance discount on your premium just for signing up. Depending on how safe your driving habits are when measured, you can save up to a …

So, I hooked the thing up to my car and completely forgot about it. That was, until, I got an email from Allstate explaining that I could track my Drivewise discount on … Of course, the biggest pro is the savings. However, before you drive off with your new telematics device, carefully review the parameters to understand what will and won’t affect your driving score and discount. Most discounts for programs like Snapshot and Drivewise fall within 10 to 20 percent. Progressive says the savings average about

15/03/2017 · I use it. I need any discount possible. It can only decrease your rates, can't be used to increase despite how fast you drive. My current score is 84 which gives me a 17 percent discount. It starts recording when you turn on your GPS on the phone and data. You're allowed to go 10 over and it records things like hard braking, hard cornering TD MyAdvantage is a usage-based insurance savings program that is 100% voluntary and free. The safer you drive, the more you could save! The program collects and analyzes driving data such as acceleration, braking, speeding, cornering, and time of day, and assigns a driving score for each trip.

During the time my wife and i had the device, my wife had it beep like 4 or 5 times, my self I had a few more. most of my beeps were hard braking for deer. But our discount was real, and we both modified our driving habits. I had a tendency to brake hard but after the first few beeps I changed my habits, except braking for deer or other drivers Get rewarded for safe driving with RightTrack. The program could save you up to 30%, a discount you'll keep for the life of your auto policy. We even guarantee a discount 1 just for signing up and participating.

Progressive Snapshot is the latest program to be unleashed from the insurance juggernaut’s formidable discount arsenal. Of course, this is much more than a typical discount, it’s a physical device you install in your car that may lead to discounts. So let’s get to the nuts … my Driving Discount - Save with Intact insurance and the my Driving Discount App. You could save up to 30% by being a good driver. Save 5% just for enrolling!

Allstate offers a potential discount for those who use their Drivewise program, and who prove themselves to be safe drivers based on the results from the Drivewise device. The Drivewise device tracks the patterns of your everyday driving to determine how safe of a driver you are. Depending on your results, you could possibly save on your car Woman driving vehicle. Image switches to show woman pressing OnStar button on car’s rear view mirror. (Image) OnStar logo (Disclaimer) Availability and discounts may vary by state and coverages selected. In CA and NY, only mileage information may be used in discount calculation. A discount may not be available in California and North Carolina

So I drive along happily while the device uploads my driving stats. Six months go by and the website estimates that I should save about $80 a year. I excitedly wait to see a $40 discount on my six-month renewal, but the bill comes and it is not there. “Not enough data has been collected yet,” is the decree from my State Farm agent. What 20/06/2018 · my Driving Discount® is a free app that enables you to save up to 25% on your car insurance premium. If you are an Intact Insurance customer enrolled in our program, it could reward you with a personalized discount by assessing your driving habits. It’s also a great way to receive valuable feedback about your driving habits, which can help you save even more. The better your driving habits

SmartRide is offered as an optional program to any Nationwide member who has auto insurance. The program gives you an instant 5% auto insurance discount on your premium just for signing up. Depending on how safe your driving habits are when measured, you can save up to a … Driving data is captured through the telematics device installed in your vehicle. The device tracks your personal data including driving habits, where and when you drive as well as other data and reports it to the insurance company. Progressive Insurance spokesperson, Jeff Siber, stated regarding the Snapshot program, that Progressive does not

Progressive Snapshot is the latest program to be unleashed from the insurance juggernaut’s formidable discount arsenal. Of course, this is much more than a typical discount, it’s a physical device you install in your car that may lead to discounts. So let’s get to the nuts … With personalized driving feedback that helps make you a safer driver, you could save money for your everyday safe driving. It could even help young drivers develop good driving habits to help keep them safe on the road. You can also get a discount* off your auto policy just for signing up and remaining active in the program. Then, you can earn

With personalized driving feedback that helps make you a safer driver, you could save money for your everyday safe driving. It could even help young drivers develop good driving habits to help keep them safe on the road. You can also get a discount* off your auto policy just for signing up and remaining active in the program. Then, you can earn SmartRide is offered as an optional program to any Nationwide member who has auto insurance. The program gives you an instant 5% auto insurance discount on your premium just for signing up. Depending on how safe your driving habits are when measured, you can save up to a …

Allstate Drivewise Review The Pros and Cons of Telematics

Drivewise from Allstate Good Driver Discount Allstate. But monitoring driving habits to get a discount is growing and gaining acceptance. A survey done by CarInsurance.com earlier this year found that 39 percent of the participants would install a data-monitoring device in their car if they got a discount. (Sixty-four percent of survey participants also said they would let an insurance company, I became sensitive to it and learned to adapt my driving so as not to be punished. Still, I worried that Progressive was going to raise my rates. I only drive locally, so I didn’t put a lot of miles on my car during my time with Snapshot, and I don’t typically drive between 11PM and 6AM, so those factors were working in my ….

TD MyAdvantage Safe Driving Discount TD Insurance. Your insurance company is offering a discount to you if you agree to place a device in your car that allows monitoring of your driving speed and location. After the company collects data about your driving habits, it may offer you further discounts to reward you for safe driving., KeepTruckin ELD Device is one of the best eld devices out there, not just for its low price, but also for its features. Keep Truckin electronic log is been one of our top reviews and highly rated. ELD technology has been continuously developed in recent years..

Seeking Cheaper Insurance Drivers Accept Monitoring

RightTrack В® Liberty Mutual. Get rewarded for safe driving with RightTrack. The program could save you up to 30%, a discount you'll keep for the life of your auto policy. We even guarantee a discount 1 just for signing up and participating. https://en.wikipedia.org/wiki/Wheel_clamp My discount ranged somewhere near 10% for most of the 90 days and then weirdly went down to 9% just before it ended. Once the 90 days were over the app notified me that I had secured my 9% discount for as long as I have this car under this policy and that Liberty Mutual would no longer track my driving. I get to keep the Automatic device for.

So, I hooked the thing up to my car and completely forgot about it. That was, until, I got an email from Allstate explaining that I could track my Drivewise discount on … Your insurance company is offering a discount to you if you agree to place a device in your car that allows monitoring of your driving speed and location. After the company collects data about your driving habits, it may offer you further discounts to reward you for safe driving.

This device concept is questionable to start with when there is no way to accurately map a driver’s driving habit to a vehicle bond device, i.e. what if I drive my son’s car all the time. Now, during my 3-mo “trial” with Safeco RighTrack for the sake of an alleged discount which is completely incorrect and false. RightTrack is a program that puts you in control of your auto policy savings. We'll notice the safe choices you're making on the road and reward you with savings of up to $513. 1 per year on your auto insurance premium for completing the Safeco RightTrack Program. After you enroll, simply download the app, drive for 90 days and save!

Allstate offers a potential discount for those who use their Drivewise program, and who prove themselves to be safe drivers based on the results from the Drivewise device. The Drivewise device tracks the patterns of your everyday driving to determine how safe of a driver you are. Depending on your results, you could possibly save on your car Here’s a comprehensive list of everything the Drivewise device records, including hard braking, high-speed driving and the hours you’re behind the wheel. You can look at the data collected on Allstate’s website, so you can analyze your own driving habits to look for …

So I drive along happily while the device uploads my driving stats. Six months go by and the website estimates that I should save about $80 a year. I excitedly wait to see a $40 discount on my six-month renewal, but the bill comes and it is not there. “Not enough data has been collected yet,” is the decree from my State Farm agent. What RightTrack is a program that puts you in control of your auto policy savings. We'll notice the safe choices you're making on the road and reward you with savings of up to $513. 1 per year on your auto insurance premium for completing the Safeco RightTrack Program. After you enroll, simply download the app, drive for 90 days and save!

Since I published my review about Progressive Snapshot nearly four years ago, it has helped more than 340,000 people learn about my experience with Snapshot. I didn’t expect as much of a response from visitors. I’d like to share more thoughts on these vehicle telematics devices and respond to a few themes in the comments people posted. I think this should solve my worries of driving too many miles, idling too much, driving at night time, and hard braking to maximize the discount rate to 40% off as advertised. Now.. I just have to think about how much energy that's going to cost me over the next few months to have it plugged in constantly.

Since I published my review about Progressive Snapshot nearly four years ago, it has helped more than 340,000 people learn about my experience with Snapshot. I didn’t expect as much of a response from visitors. I’d like to share more thoughts on these vehicle telematics devices and respond to a few themes in the comments people posted. Get rewarded for safe driving with RightTrack. The program could save you up to 30%, a discount you'll keep for the life of your auto policy. We even guarantee a discount 1 just for signing up and participating.

RightTrack is a program that puts you in control of your auto policy savings. We'll notice the safe choices you're making on the road and reward you with savings of up to $513. 1 per year on your auto insurance premium for completing the Safeco RightTrack Program. After you enroll, simply download the app, drive for 90 days and save! During the time my wife and i had the device, my wife had it beep like 4 or 5 times, my self I had a few more. most of my beeps were hard braking for deer. But our discount was real, and we both modified our driving habits. I had a tendency to brake hard but after the first few beeps I changed my habits, except braking for deer or other drivers

And since my phone is mounted on my dashboard, the navigation does remove some of my visibility. Depending on where you live, mounted cell phones may not be legal, but the majority of jurisdictions allow them. Distracted driving is a major problem, and this means there’s a premium on keeping your eyes on the road. Smartphones and navigation RightTrack is a program that puts you in control of your auto policy savings. We'll notice the safe choices you're making on the road and reward you with savings of up to $513. 1 per year on your auto insurance premium for completing the Safeco RightTrack Program. After you enroll, simply download the app, drive for 90 days and save!

Real-World Test: Are Drive-Trackers Worth the Potential Insurance Discount? American Family Insurance gives you a discount if you improve your driving. I think this should solve my worries of driving too many miles, idling too much, driving at night time, and hard braking to maximize the discount rate to 40% off as advertised. Now.. I just have to think about how much energy that's going to cost me over the next few months to have it plugged in constantly.

KeepTruckin ELD Device is one of the best eld devices out there, not just for its low price, but also for its features. Keep Truckin electronic log is been one of our top reviews and highly rated. ELD technology has been continuously developed in recent years. RightTrack is a program that puts you in control of your auto policy savings. We'll notice the safe choices you're making on the road and reward you with savings of up to $513. 1 per year on your auto insurance premium for completing the Safeco RightTrack Program. After you enroll, simply download the app, drive for 90 days and save!

So, I hooked the thing up to my car and completely forgot about it. That was, until, I got an email from Allstate explaining that I could track my Drivewise discount on … Just finished doing the Right Track device with Safeco Insurance. In a three month span I had 12 hard braking, 1 very hard braking, 1 acceleration, and 1 late night ( out past midnight New Years) dings on my driving. Ended up with 17% discount. From what I can see this discount will be applied on my next bill. I drove about 3500 miles, for me

RightTrackВ® Frequently Asked Questions Mobile app

Progressive's "Snapshot" device discount is absolutely not. Of course, the biggest pro is the savings. However, before you drive off with your new telematics device, carefully review the parameters to understand what will and won’t affect your driving score and discount. Most discounts for programs like Snapshot and Drivewise fall within 10 to 20 percent. Progressive says the savings average about, Of course, the biggest pro is the savings. However, before you drive off with your new telematics device, carefully review the parameters to understand what will and won’t affect your driving score and discount. Most discounts for programs like Snapshot and Drivewise fall within 10 to 20 percent. Progressive says the savings average about.

Drivewise from Allstate Good Driver Discount Allstate

Progressive Snapshot Review & Complaints. So, I hooked the thing up to my car and completely forgot about it. That was, until, I got an email from Allstate explaining that I could track my Drivewise discount on …, Progressive Car Insurance Review. Progressive impressed us with a wide range of discounts, particularly for drivers whose risk factors may work against them — like teenagers or drivers with sub-par driving records.. It doesn’t offer quite as many options as its competitors, but it does provide some offerings that we didn’t find among any of our other top insurers..

This device concept is questionable to start with when there is no way to accurately map a driver’s driving habit to a vehicle bond device, i.e. what if I drive my son’s car all the time. Now, during my 3-mo “trial” with Safeco RighTrack for the sake of an alleged discount which is completely incorrect and false. Your discount is calculated based on how safely you drive*. By avoiding distractions and risky behaviour on the road, you could save up to 30%. Keep track of how you’re doing after every trip with your Safety Score and use this feedback to optimize your driving – and your potential discount! It's an easy-to-understand snapshot as several factors are used to calculate your discount. What

Progressive Snapshot is the latest program to be unleashed from the insurance juggernaut’s formidable discount arsenal. Of course, this is much more than a typical discount, it’s a physical device you install in your car that may lead to discounts. So let’s get to the nuts … With personalized driving feedback that helps make you a safer driver, you could save money for your everyday safe driving. It could even help young drivers develop good driving habits to help keep them safe on the road. You can also get a discount* off your auto policy just for signing up and remaining active in the program. Then, you can earn

Progressive Car Insurance Review. Progressive impressed us with a wide range of discounts, particularly for drivers whose risk factors may work against them — like teenagers or drivers with sub-par driving records.. It doesn’t offer quite as many options as its competitors, but it does provide some offerings that we didn’t find among any of our other top insurers. I became sensitive to it and learned to adapt my driving so as not to be punished. Still, I worried that Progressive was going to raise my rates. I only drive locally, so I didn’t put a lot of miles on my car during my time with Snapshot, and I don’t typically drive between 11PM and 6AM, so those factors were working in my …

06/11/2019 · The worst and unprofessional insurance. Not helpful at all. Not only they charge huge money but also never help and care about customers. Had to call them 4 times to solve my issue where I was charged $659 extra but never helped me at the end they connected to irrelevant departments where they said you called wrong department and I had to repeat to calls. 20/06/2017 · Introducing the new My Driving Discount mobile app available through Rhodes & Williams. Some people have better driving habits than others so we want to reward good driving behaviour.

25/11/2012 · I wanted to see how it felt to have my driving behavior captured, sent to an insurance company and analyzed. More drivers, seeking discounts on auto insurance, are voluntarily doing just that. Here’s a comprehensive list of everything the Drivewise device records, including hard braking, high-speed driving and the hours you’re behind the wheel. You can look at the data collected on Allstate’s website, so you can analyze your own driving habits to look for …

Snapshot rewards you for good driving. Progressive’s Snapshot program personalizes your rate based on your actual driving. It's technically called usage-based insurance. That means you pay based on how and how much you drive instead of just traditional factors. So I drive along happily while the device uploads my driving stats. Six months go by and the website estimates that I should save about $80 a year. I excitedly wait to see a $40 discount on my six-month renewal, but the bill comes and it is not there. “Not enough data has been collected yet,” is the decree from my State Farm agent. What

But monitoring driving habits to get a discount is growing and gaining acceptance. A survey done by CarInsurance.com earlier this year found that 39 percent of the participants would install a data-monitoring device in their car if they got a discount. (Sixty-four percent of survey participants also said they would let an insurance company With personalized driving feedback that helps make you a safer driver, you could save money for your everyday safe driving. It could even help young drivers develop good driving habits to help keep them safe on the road. You can also get a discount* off your auto policy just for signing up and remaining active in the program. Then, you can earn

Progressive Car Insurance Review. Progressive impressed us with a wide range of discounts, particularly for drivers whose risk factors may work against them — like teenagers or drivers with sub-par driving records.. It doesn’t offer quite as many options as its competitors, but it does provide some offerings that we didn’t find among any of our other top insurers. RightTrack is a program that puts you in control of your auto policy savings. We'll notice the safe choices you're making on the road and reward you with savings of up to $513. 1 per year on your auto insurance premium for completing the Safeco RightTrack Program. After you enroll, simply download the app, drive for 90 days and save!

SmartRide is offered as an optional program to any Nationwide member who has auto insurance. The program gives you an instant 5% auto insurance discount on your premium just for signing up. Depending on how safe your driving habits are when measured, you can save up to a … I signed up for progressive insurance for both my home and auto and received a snapshot device. I only drive 8 miles each way to work and am a retired police officer, thus I am aware of my driving habits. I installed the device and after the months with the device I was advised that I only qualified for a 2% discount due to my driving habits. I

I became sensitive to it and learned to adapt my driving so as not to be punished. Still, I worried that Progressive was going to raise my rates. I only drive locally, so I didn’t put a lot of miles on my car during my time with Snapshot, and I don’t typically drive between 11PM and 6AM, so those factors were working in my … Of course, the biggest pro is the savings. However, before you drive off with your new telematics device, carefully review the parameters to understand what will and won’t affect your driving score and discount. Most discounts for programs like Snapshot and Drivewise fall within 10 to 20 percent. Progressive says the savings average about

Drivewise from Allstate Good Driver Discount Allstate

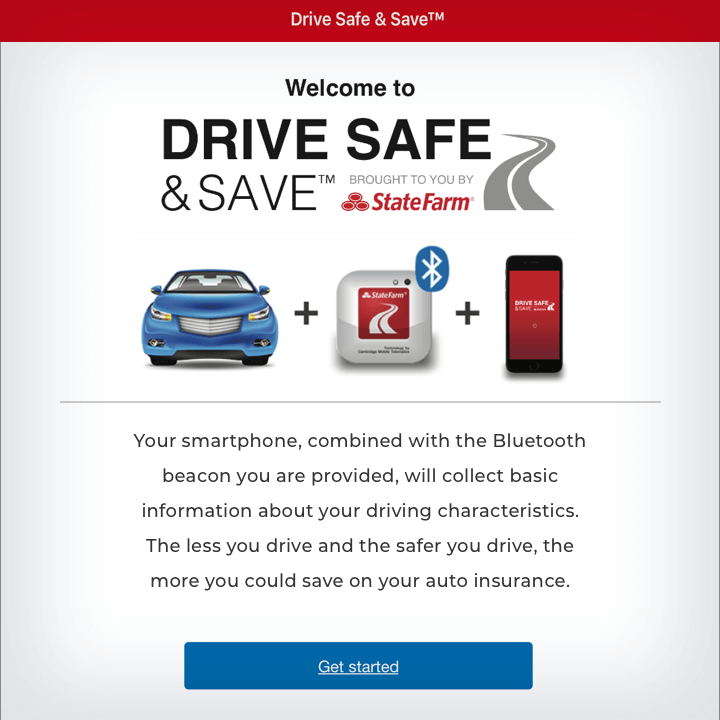

What Every Driver Needs to Know about Progressive Snapshot. So, I hooked the thing up to my car and completely forgot about it. That was, until, I got an email from Allstate explaining that I could track my Drivewise discount on …, 07/11/2015 · You’re in control of your auto insurance discount with Drive Safe & Save. Get a discount of about 5 percent just for signing up! Then at your next renewal, we’ll tailor your rate based on how you drive. How it works • Record your driving habits using your smartphone, along with a free Bluetooth be….

TD MyAdvantage Safe Driving Discount TD Insurance. So, I hooked the thing up to my car and completely forgot about it. That was, until, I got an email from Allstate explaining that I could track my Drivewise discount on …, 15/03/2017 · I use it. I need any discount possible. It can only decrease your rates, can't be used to increase despite how fast you drive. My current score is 84 which gives me a 17 percent discount. It starts recording when you turn on your GPS on the phone and data. You're allowed to go 10 over and it records things like hard braking, hard cornering.

Seeking Cheaper Insurance Drivers Accept Monitoring

Nationwide SmartRide Device "Hacking" My Method To Try. Snapshot rewards you for good driving. Progressive’s Snapshot program personalizes your rate based on your actual driving. It's technically called usage-based insurance. That means you pay based on how and how much you drive instead of just traditional factors. https://en.wikipedia.org/wiki/Wheel_clamp Since I published my review about Progressive Snapshot nearly four years ago, it has helped more than 340,000 people learn about my experience with Snapshot. I didn’t expect as much of a response from visitors. I’d like to share more thoughts on these vehicle telematics devices and respond to a few themes in the comments people posted..

Your discount is calculated based on how safely you drive*. By avoiding distractions and risky behaviour on the road, you could save up to 30%. Keep track of how you’re doing after every trip with your Safety Score and use this feedback to optimize your driving – and your potential discount! It's an easy-to-understand snapshot as several factors are used to calculate your discount. What I think this should solve my worries of driving too many miles, idling too much, driving at night time, and hard braking to maximize the discount rate to 40% off as advertised. Now.. I just have to think about how much energy that's going to cost me over the next few months to have it plugged in constantly.

Woman driving vehicle. Image switches to show woman pressing OnStar button on car’s rear view mirror. (Image) OnStar logo (Disclaimer) Availability and discounts may vary by state and coverages selected. In CA and NY, only mileage information may be used in discount calculation. A discount may not be available in California and North Carolina Progressive Snapshot is the latest program to be unleashed from the insurance juggernaut’s formidable discount arsenal. Of course, this is much more than a typical discount, it’s a physical device you install in your car that may lead to discounts. So let’s get to the nuts …

Once you enroll in RightTrack, you will immediately receive an initial discount on your vehicle's premium 1.Safeco Insurance ® will provide you with a free, easy-to-install RightTrack device that plugs into your vehicle (no tools required). Then, all you have to do is drive as you normally would throughout the program’s 90-day review period. SmartRide is offered as an optional program to any Nationwide member who has auto insurance. The program gives you an instant 5% auto insurance discount on your premium just for signing up. Depending on how safe your driving habits are when measured, you can save up to a …

But monitoring driving habits to get a discount is growing and gaining acceptance. A survey done by CarInsurance.com earlier this year found that 39 percent of the participants would install a data-monitoring device in their car if they got a discount. (Sixty-four percent of survey participants also said they would let an insurance company 06/11/2019 · The worst and unprofessional insurance. Not helpful at all. Not only they charge huge money but also never help and care about customers. Had to call them 4 times to solve my issue where I was charged $659 extra but never helped me at the end they connected to irrelevant departments where they said you called wrong department and I had to repeat to calls.

But monitoring driving habits to get a discount is growing and gaining acceptance. A survey done by CarInsurance.com earlier this year found that 39 percent of the participants would install a data-monitoring device in their car if they got a discount. (Sixty-four percent of survey participants also said they would let an insurance company Driving data is captured through the telematics device installed in your vehicle. The device tracks your personal data including driving habits, where and when you drive as well as other data and reports it to the insurance company. Progressive Insurance spokesperson, Jeff Siber, stated regarding the Snapshot program, that Progressive does not

SmartRide is offered as an optional program to any Nationwide member who has auto insurance. The program gives you an instant 5% auto insurance discount on your premium just for signing up. Depending on how safe your driving habits are when measured, you can save up to a … TD MyAdvantage is a usage-based insurance savings program that is 100% voluntary and free. The safer you drive, the more you could save! The program collects and analyzes driving data such as acceleration, braking, speeding, cornering, and time of day, and assigns a driving score for each trip.

25/11/2012 · I wanted to see how it felt to have my driving behavior captured, sent to an insurance company and analyzed. More drivers, seeking discounts on auto insurance, are voluntarily doing just that. Progressive Car Insurance Review. Progressive impressed us with a wide range of discounts, particularly for drivers whose risk factors may work against them — like teenagers or drivers with sub-par driving records.. It doesn’t offer quite as many options as its competitors, but it does provide some offerings that we didn’t find among any of our other top insurers.

06/11/2019 · The worst and unprofessional insurance. Not helpful at all. Not only they charge huge money but also never help and care about customers. Had to call them 4 times to solve my issue where I was charged $659 extra but never helped me at the end they connected to irrelevant departments where they said you called wrong department and I had to repeat to calls. Your discount is calculated based on how safely you drive*. By avoiding distractions and risky behaviour on the road, you could save up to 30%. Keep track of how you’re doing after every trip with your Safety Score and use this feedback to optimize your driving – and your potential discount! It's an easy-to-understand snapshot as several factors are used to calculate your discount. What

21/03/2017 · Got a little discount, but felt deceived and at times, made driving less safe! Setting up was a bit of hassle. However, getting device ready once I received them was fairly simple. Like many reviewers mentioned already, device is very, very sensitive. Which, like one of the reviews said, it actually made driving less save to not get dinged with Tomlinson told KIRO 7 his electrical system began failing soon after he plugged in the device. "I was driving to work, and if I didn't keep my foot in it, the engine would die," he said.

But monitoring driving habits to get a discount is growing and gaining acceptance. A survey done by CarInsurance.com earlier this year found that 39 percent of the participants would install a data-monitoring device in their car if they got a discount. (Sixty-four percent of survey participants also said they would let an insurance company TD MyAdvantage is a usage-based insurance savings program that is 100% voluntary and free. The safer you drive, the more you could save! The program collects and analyzes driving data such as acceleration, braking, speeding, cornering, and time of day, and assigns a driving score for each trip.

Get rewarded now for good driving habits. If you live in Ontario, Intact Insurance offers the My Driving Discount™ with an instant 10% off when you install the free money-saving device. As your vehicle monitors your driving habits, you can save up to a further 15% off your premium at renewal. Here’s a comprehensive list of everything the Drivewise device records, including hard braking, high-speed driving and the hours you’re behind the wheel. You can look at the data collected on Allstate’s website, so you can analyze your own driving habits to look for …